您现在的位置是:Fxscam News > Exchange Brokers

Tariff fears fuel U.S. consumer pessimism, with rising inflation and recession concerns.

Fxscam News2025-07-22 08:40:58【Exchange Brokers】9人已围观

简介Foreign exchange collection,What is the most important trader in foreign exchange trading,U.S. Consumer Confidence Declines: Financial Concerns Intensify Amid Tariff UncertaintyAccording to

U.S. Consumer Confidence Declines: Financial Concerns Intensify Amid Tariff Uncertainty

According to a recent survey by the credit reporting agency TransUnion,Foreign exchange collection American consumers are becoming increasingly pessimistic due to ongoing inflationary pressures and tariff uncertainties. As living costs rise and spending behaviors change, financial stress has become a central issue for mainstream households.

Tariffs Trigger a Surge in Financial Pessimism

TransUnion surveyed nearly 3,000 consumers in May 2025, revealing that 27% of respondents were pessimistic about their household financial situation over the next 12 months, a significant increase from 21% in the fourth quarter of last year.

Charlie Wise, TransUnion's global research and consulting director, noted: "This sharp rise in pessimism is clearly related to tariff policies." He indicated that many families' concerns over rising prices have transitioned from potential anxiety to actual behavioral changes.

Consumers Reduce Spending, Increase Savings

Facing an uncertain economic environment and cost pressures from tariffs, over half of consumers are cutting down on non-essential expenditures. Data shows:

- More than 50% have reduced discretionary spending on dining out, travel, and entertainment.

- 23% of respondents have started increasing emergency savings for unforeseen needs.

Wise commented that this reflects consumers' nervousness about future uncertainties, as they prepare proactively for tougher financial times.

Rising Demand for Loans Might Heat Up Credit Risks

Despite a stronger inclination to save, with incomes not growing at the same pace, some consumers are choosing to increase borrowing to maintain basic expenditures:

- Some respondents plan to access liquidity through credit cards, personal loans, or "Buy Now, Pay Later" services.

- Among all surveyed groups, the most eager to borrow are those most concerned about tariffs.

This could signal a rise in credit demand while also posing potential risks, especially given that interest rates remain relatively high, possibly accumulating credit risk.

Inflation Remains a Primary Concern, Recession Fears Heighten

The survey also noted that 81% of respondents still consider inflation their primary concern. Concerns about a recession have climbed to their highest level in two years, indicating a rapidly weakening public expectation of future macroeconomic trends.

Wise stated: "Although the job market hasn't significantly weakened yet, consumers' concerns about the future reflect unstable confidence, which typically precedes impacts on spending and borrowing decisions."

Tariff Costs Spill Over, Challenging U.S. Household Confidence

TransUnion's report clearly reveals a trend: tariff policies not only alter the global supply chain structure but also erode the financial expectations of ordinary American families. As consumer confidence declines, spending slowdowns could hamper economic growth momentum. If tariffs continue to escalate, consumer spending patterns and borrowing behaviors are likely to become more conservative, prompting the Federal Reserve and policymakers to closely monitor their spillover effects on the long-term macroeconomic impact.

Risk Warning and DisclaimerThe market carries risks, and investment should be cautious. This article does not constitute personal investment advice and has not taken into account individual users' specific investment goals, financial situations, or needs. Users should consider whether any opinions, viewpoints, or conclusions in this article are suitable for their particular circumstances. Investing based on this is at one's own responsibility.

很赞哦!(18)

相关文章

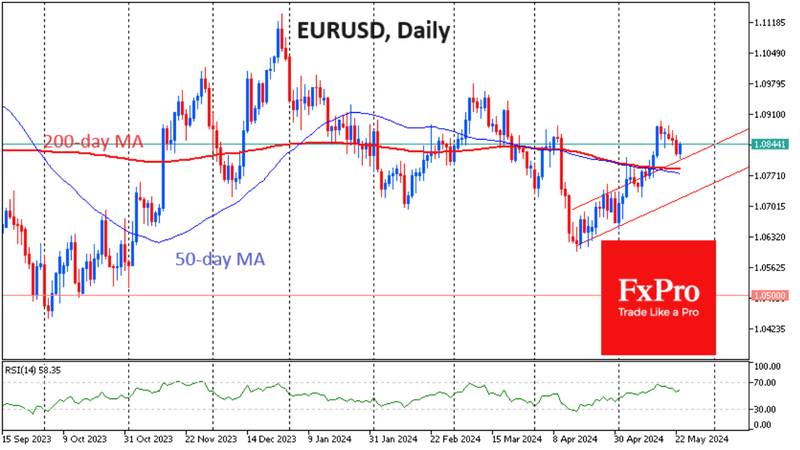

- Market Insights: Feb 1st, 2024

- Copper market bulls predict new highs for copper prices as the U.S. market faces supply tightness.

- Gold slightly rebounds as the trade agreement boosts market safe

- Gold prices are rising, with the target price expected to surpass $3,500.

- Is Namibia, one of the top 15 oil

- Gold prices soar, with JPMorgan projecting an increase to $4,000.

- Gold prices remain stable as a weaker dollar supports the market.

- Crude oil inventories decline, causing oil prices to fluctuate in the short term.

- EC Markets: Sharing Prosperity, Brand Ambassador Trump Triumphs at 2024 Snooker World Open.

- CBOT grain futures are mixed, wheat under pressure, soybean oil rebounds.

热门文章

- Analysts believe Softbank may turn losses into profits in the first quarter.

- Oil prices rebound as OPEC+ boosts production and US

- Gold prices have risen for three consecutive weeks, but a strong dollar dragged them down on Friday.

- Trump's tariff expectations unsettle the agricultural futures market.

站长推荐

Market Insights: Feb 26th, 2024

U.S. tariff threat sparks copper import surge and price spike.

CBOT grains diverge: soybeans, oils fall; wheat fluctuates; corn rebounds.

Oil prices have plummeted, falling below $60, and the market still faces great uncertainty.

Chasoe Review: High Risk (Suspected Scam)

Oil prices are fluctuating at high levels due to geopolitical factors and demand signals.

Trump's global tariff plan boosts safe

U.S. crude oil inventories unexpectedly surged, causing WTI oil prices to retreat under pressure.